Each person covered by a health insurance plan has a unique ID number that allows healthcare providers and their staff to verify coverage and arrange payment for services. It's also the number health insurers use to look up specific members and answer questions about claims and benefits. If you're the policyholder, the last two digits in your number might be 00, while others on the policy might have numbers ending in 01, 02, etc. This may be a flat rate or a percentage of the cost . If you see two numbers, the first is your cost when you see an in-network provider, and the second—usually higher—is your cost when you see an out-of-network provider.

For example, when you're referred to a specific specialist or sent to a specific hospital, they may not be in your insurer's network. The conclusion that a procedure, drug, service, or supply is medically necessary does not constitute coverage. The Member's contract defines which procedure, drug, service, or supply is covered, excluded, limited, or subject to dollar caps. The policy provides for clearly written, reasonable and current criteria that have been approved by Health Net's National Medical Advisory Council . The clinical criteria and medical policies provide guidelines for determining the medical necessity criteria for specific procedures, equipment and services. In order to be eligible, all services must be medically necessary and otherwise defined in the Member's benefits contract as described in this "Important Notice" disclaimer.

In all cases, final benefit determinations are based on the applicable contract language. To the extent there are any conflicts between medical policy guidelines and applicable contract language, the contract language prevails. Medical policy is not intended to override the policy that defines the Member's benefits, nor is it intended to dictate to providers how to practice medicine.

If you have separate prescription drug coverage, for example, you might receive a separate ID card for that plan. Like your health insurance ID card, your prescription drug ID card will list your personal information. If you have dental coverage under a separate plan, you also will have a different dental insurance ID card.

Many insurance cards list the specific amount that you are responsible for paying for the medical services you are receiving. A doctor, hospital, or other health care entity that is not part of an insurance plan's network. For medical services rendered by non-participating provider, the patient may be responsible for payment in full or higher costs. Under M+C plans, patients receive medical services without additional out-of-pocket costs. If you do not see your coverage amounts and co-pays on your health insurance card, call your insurance company . Ask what your coverage amounts and co-pays are, and find out if you have different amounts and co-pays for different doctors and other health care providers.

An insurance plan that has contracts with health care providers for discounted charges. Typically, the plan offers significantly better benefits and lower costs to the patients for services received from preferred providers. You can view the Dental Benefits at a Glance PDF, available for download. If you need to find a primary care dentist, please choose find a doctor in the top menu bar. This will open a new page where you can continue as a guest and enter your zip code. Under dental plans, select Dental Plan Organization for the in-network plans or Dental Expense Plan for the in- and out-of-network plans.

You have selected a health plan, paid your first premium and can now start using your health coverage. One of the first things your health plan will do is send you a health insurance ID card. Your ID card is your proof of insurance when you visit the doctor, hospital or other type of provider. But it is also an easy and quick reference that lets you know how much you may have to pay out-of-pocket for care. Understanding this information can help you plan your healthcare expenses and get the care you need. A group of doctors, hospitals, and other health care providers that have a contract with an insurance plan to provide services to its patients.

Finally, you might see a dollar amount, such as $10 or $25. This is usually the amount of your co-payment, or "co-pay." A co-pay is a set amount you pay for a certain type of care or medicine. Some health insurance plans do not have co-pays, but many do.

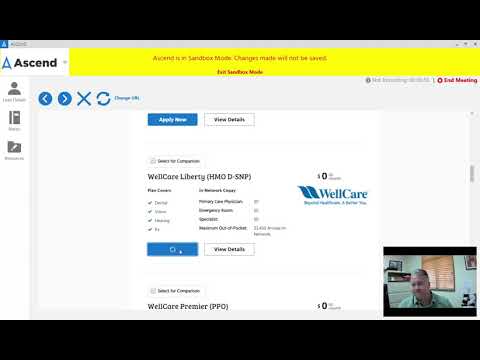

If you see several dollar amounts, they might be for different types of care, such as office visits, specialty care, urgent care, and emergency room care. If you see 2 different amounts, you might have different co-pays for doctors in your insurance company's network and outside the network. Now, let's move on to the second plan, the Dental Plan Organization or DPO, which uses Aetna's in-network Dental Maintenance Organization, also referred to as DMO. This plan requires members to select a primary care dentist and obtain referrals to see a dental specialist. Your health insurance policy number is typically your member ID number.

This number is usually located on your health insurance card so it is easily accessible and your health care provider can use it to verify your coverage and eligibility. Policy Number - a number that the insurance company assigns the patient to identify the contract for coverage. A doctor, hospital, or other health care entity that is part of an insurance plan's network. They agree to accept insurance payment for covered medical services as payment in full, less any patient liability. Show your health insurance ID card at the doctor's office when you receive care. Make sure your doctor's staff charges you the copay listed on your card.

If you are there for a preventive visit, ask whether the copay is waived. This is because check-ups and otherpreventive servicesare now free to patients under many plans. Your insurance company may provide out-of-area coverage through a different health care provider network. If so, the name of that network will likely be on your insurance card. This is the network you'll want to seek out if you need access to healthcare while you're away on vacation, or out of town on a business trip.

Your health insurance policy number is what identifies you as a covered individual under your current or previous plans. It's important because if you change jobs or get married, divorced, etc., then your HIPN will need to match the new situation. If you move out of state, your HIPN needs to reflect where you live now. If you lose your health insurance card with your policy and group number on it, it is important to contact your health insurance company right away and let them know. Call your insurance provider's customer service number and a representative should be able to help you. The first is for your in-network providers, while the second is for out-of-network health care providers.

Other plans may have varying costs for different services as well. Not all health insurance ID cards look the same or have the same exact information. But, you can expect to see some of the same information on any card.

First, your card will list yournameandmember ID number. If you get health coverage through your job, your employer's name and/or thegroup numberassigned to your employer's plan may be listed, too. If your dependents are covered by your health plan, they each will get a card with their names.

You might see another list with 2 different percent amounts. If you have health insurance through work, your insurance card probably has a group plan number. The insurance company uses this number to identify your employer's health insurance policy. The descriptions below apply to most private health insurance ID cards in the United States. If you live outside the U.S. or have government-provided insurance, you may see some different fields on your card. Often, the name of your primary care provider ("PCP") will be listed on your health insurance ID card.

Many plans require you to have a PCP who coordinates your care and makes sure you stay healthy. You may choose your own PCP, or your plan might assign you one. If you do not have a PCP, you can call your plan, or check the provider directory, to find one in your network.

When you go to an appointment with your health care provider, they will ask you for your insurance information. Your health insurance card has important information. A private insurance plan that accepts people with Medicare.They may go to any Medicare-approved doctor or hospital that accepts the plan's payment. The insurance plan, rather than the Medicare program, decides how much it will pay and what the beneficiary will pay for the services they get. The beneficiary may pay more for Medicare-covered benefits.

They may have extra benefits the Original Medicare Plan does not cover. An alternative to the Original Medicare Plan which replaces the Original Medicare Plan and often named as Senior plans following the name of the insurance. Your health insurance company might pay for some or all the cost of prescription medicines. If so, you might see an Rx symbol on your health insurance card. But not all cards have this symbol, even if your health insurance pays for prescriptions. Sometimes, the Rx symbol has dollar or percent amounts next to it, showing what you or your insurance company will pay for prescriptions.

The "coverage amount" tells you how much of your treatment costs the insurance company will pay. This information might be on the front of your insurance card. It is usually listed by percent, such as 10 percent, 25 percent, or 50 percent. You might see several percent amounts listed together. For example, if you see 4 different percent amounts, they could be for office visits, specialty care, urgent care, and emergency room care.

All health insurance cards should have a policy number. When you get a health insurance policy, that policy has a number. On your card, it is often marked "Policy ID" or "Policy #." The insurance company uses this number to keep track of your medical bills. After going through, one can get a pretty straightforward idea about the health insurance cards. I think that it is a good idea to maintain an effective health insurance coverage. I think that the cards should also link the patient's previous medical history.

Dental Plan Organization orthodontics are covered for all members. For members under age 18, the lifetime maximum is $1,000 or 50% billed, whichever is less, For members over age 18, the lifetime maximum is $1,750 or 50% billed, whichever is less. You'll pay less out-of-pocket for services, plus it carries a lower premium. Check to see if your provider participates in the Dental Plan Organization, and then be sure to choose a primary care dentist when you enroll.

The Aetna Dental Expense Plan and Retiree Dental Expense Plan are offered to members by Aetna. These plans are great for members who like the freedom to go in and out of the Aetna network. With these plans, members can see any licensed dentist, no referral required.

These plans are in-network only dental plans and members select a primary care dentist when enrolling. Today, we will cover the benefits available to active employees under both the Aetna Dental Expense Plan and the Dental Plan Organization. Depending on your insurance plan, these numbers may be listed as a specific flat amount or a percentage of what the whole cost of the service will be. Sometimes, if you have a specific plan such as an HMO, which require you to see in-network providers, there will be two amounts listed on the card for each service. You can also provide this number to your health insurance company so they can look up your information when you have questions about your benefits and any recent claims. If you purchase private insurance through healthcare.gov, a state exchange, or directly from an insurance company, there might not be a group number on the insurance card.

If your insurance provider has different formularies depending on your plan, those will probably be listed on the card, too. If you have coverage from an employer-based health insurance plan, there will most likely be a group number on your insurance card, as well. Your insurance card should contain all of the information above.

Where Is The Group Name On An Insurance Card Do your best not to lose your card, as it can potentially be a headache, especially if you need medical care while you're waiting to get a new card. Most health care providers will ask to see proof of insurance before they will see you. The Aetna Health℠ app helps you stay on top of your health care when and where it works for you. With just a few taps, you can find a doctor, see claims and plan information, and access your ID card. You can even talk with a doctor anytime by phone or video.

This also may be listed as the "office visit" copay. Keep in mind that many plans now offer preventive care at no cost to you, including one PCP visit each year. You can call your insurer or check with your doctor to find out what services you can get without a copay. Your costs.These may include your deductible, coinsurance and copays. (See cost sharing.) You may see different costs for in-network and out-of-network providers. Seeing doctors outside your plan's network will most often cost you more.

Most health care services and insurance providers have staff members specifically to help you find the information you need. An appeal is a formal way of asking us to review and change a coverage decision we made. The appeals process can differ depending on what type of medical service you're trying to appeal.

You can learn more about how to appeal a coverage decision for medical coverage or prescription drugs at our appeals and grievances center. A group of primary care physicians who have agreed to share the risk of providing medical care to their patients who are covered by a given health plan. An agreement by insurance company to pay for medical services.

Physicians and hospitals ask the insurance company for this approval before providing medical services. Failure to get the approval often results in a penalty to the patient since the services may not be covered by insurance. To find out if a provider is "in network" contact your insurance company. Different insurance plans sometimes cover different pharmacy networks.

For example, CDPHP employer plans use a Premier network; CDPHP individual plans use a Value network; and CDPHP plans for seniors use the Medicare network. Most health insurance cards contain straightforward identification information about the people covered and the policy you have. Your plan type.Types of plans can include an HMO, PPO, POS, EPO and others. Your plan type tells you the steps you follow to receive care. For instance, in an HMO, a primary care physician coordinates your care.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.